Update: September 9, 2022

11 Alternatives to PayPal

Something driving you away from PayPal?

Cash may still be king, but online payments are here to stay, and you’re no longer limited to one online payment option.

PayPal has been around for a longtime, but hasn’t updated their model to compete with the flood of newer options out there. As such, many longtime PayPal users are being rubbed the wrong way by high fees, chargebacks, dispute issues and lackluster seller protections. Better options are out there, and we’ve complied them for you.

Our Top 4 Alternatives

4 Additional Options to Consider

- WePay

- FastSpring

- Shopify Payments

- Wise (formerly TransferWise)

See 3 additional options at the end of this article.

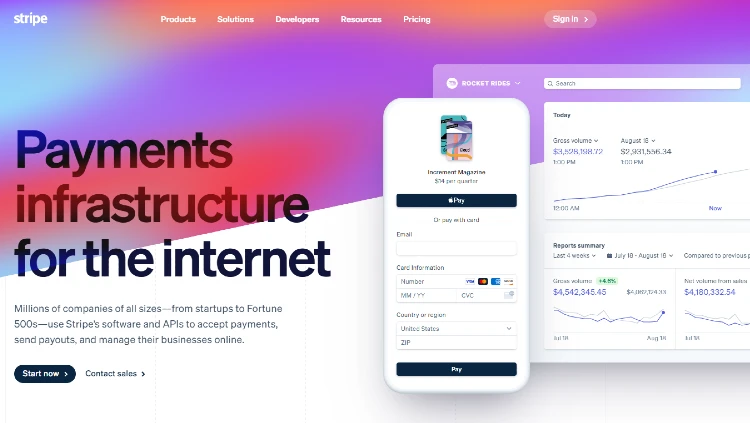

Stripe was built from the ground up to handle businesses large or small, and they offer some distinct advantages compared to PayPal and the others listed here. Stripe does charge the same standard 2.9% + $0.30 per transaction that PayPal does, but if you do any international business then Stripe becomes the better choice for you as the fees are less.

They also lead the way in forms of payments accepted by a wide margin. If you’re fully integrating Stripe as your payment processor or even just as an alternative to one you already have set up then Stripe will allow for a much wider variety of payment types. See below for the full scope of their accepted payments.

Stripe is a well-designed payment platform for every business that excels at being flexible. With just one integration you can begin handling transactions from across the globe, which is often something that requires multiple integrations with other competitors. The sheer amount of payment options accepted make Stripe a serious competitor.

Everyone knows Google and nearly 2 billion people across the globe use an Android phone, so it shouldn’t come as a surprise that their payment alternative is number 2 on our list. Google Pay is a contactless payment method used by millions of stores (mostly in the U.S. and Europe) and offers great protection for the consumer.

Integrating with Google Pay offers you the ability to use the Google Passes app which will allow for you to create loyalty cards, gift cards and discount codes for your customers. This also allows the customer to immediately access purchase history and rewards. You can also use the app to send location-based notifications if for instance a customer is near your shop but hasn’t visited in a while.

As for security, Google uses an encrypted number instead of an actual card number so that sensitive user data is never revealed to an unsecure platform.

Google Pay works with phones, tablets and watches that either have the app or use Android. It does require a Google account but having this as an alternative payment method can provide you a layer of security while pleasing customers that don’t wish to find their wallet.

The best part? Google doesn’t charge anything but the standard credit card fees.

The direct competitor to Google Pay is obviously Apple Pay. They rank as number three on our list simply because they don’t have the considerable number of users that Android does. However, if your business is primarily focused on the U.S. market then integrating Apple Pay into your payment options is something to investigate considering how good Apple is at integrating their systems into their user’s daily lives.

With Apple Pay, businesses can collect cashless payments from anyone with an iPhone or other Apple device. Apple Pay’s ability to both send and receive money makes this a perfect addition to your payment options, or as a stand-alone alternative if you really cater to the Apple market. Like, Google Pay but without the additional app businesses can create loyalty programs directly through Apple Pay.

Apple Pay is accepted at a wide variety of locations, accepts most cards and payment providers and there are no fees passed on to the business.

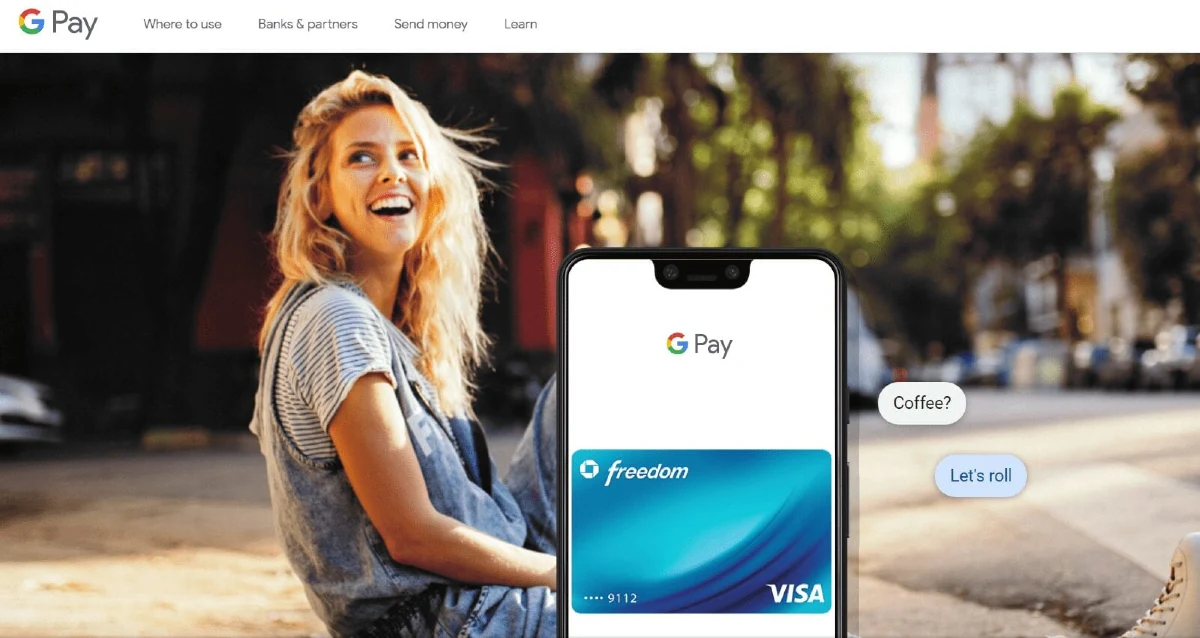

Rounding out our top four is Amazon Pay. Not as ubiquitous as Google or Apple Pay, but still a contender that is worth looking at, especially if you conduct business internationally. Any Amazon account holder can seamlessly checkout on your website simply by clicking the button and logging in to their account. Any payment processed by Amazon via this method is covered by Amazon’s “A to Z Guarantee”.

As a business, you’ll also know that your customer is a legitimate buyer as their account is verified by Amazon and their fraud protection services. It means fewer headaches for you overall.

On a personal note, I frequently encounter Amazon Pay when purchasing products from overseas, and it offers excellent integration, security and peace of mind that a normal credit card transaction does not. Amazon Pay charges the standard 2.9% $0.30 per U.S. based transaction.

Acquired by JP Morgan Chase in late 2017, WePay processes payments and integrates with many existing systems businesses are using. The major benefit of WePay is that you’re able to get access to same day deposits (Chase account required) and seamlessly integrate your payment information into the systems you’re already using.

With just a few quick lines of code that nearly anyone can add, you can begin accepting payments immediately. Depending on your needs you can also hand the backend over to Chase and let them do all the work of handling your payments while you retain control over the overall design of the payment area.

An exact breakdown of their charges requires contacting their sales team.

A full-service ecommerce platform that is trusted by big names such as Adobe, but specializes in localized payment processing to achieve more conversions. FastSpring estimates that by using them you’ll reduce cart abandonment and see an increase in revenue.

They support a wide variety of payment methods, over 20 currencies and nearly 20 languages, so you can rely on them to be your main payment processor. You’re able to create branded checkout areas, create and manage subscription services and integrate with other services seamlessly.

One of the major benefits to FastSpring is that if the first transaction fails for any reason, it will automatically redirect to a participating bank and try the transaction again, rather than cancelling it outright due to something like a server error. This will help reduce cart abandonment and frustration with your website, even if it isn’t your fault.

FastSpring has higher fees than the others listed above, which knocks it into the bottom four, but it is a full ecommerce solution. 8.9% flat fee per transaction or a variable model that adds a fee based on 5.9% of the total transaction + $0.95.

If you’re already selling on Shopify then this is really the provider for you and if you’re looking to create a new store then the seamless integration provided by Shopify and Shopify Payments is attractive. Setup is one click and requires no third-party integrations, so it doesn’t get any easier than that to accept payments.

It is a secure and trusted service that boasts hundreds of thousands of businesses as users, and it uses all major payment methods and currencies.

The downside to this seamless integration is the cost – 29/mo + 2.9% + $0.30 per transaction which may price out a lot of new businesses.

The main appeal to Wise is that they provide a real-time currency exchange rate, and you can receive money without any fees. This makes them about 4x cheaper than most international business merchant processors.

Wise is best for businesses that process a considerable percentage of their transactions in or from foreign currencies. If you’re a small business using PayPal with international receipts of $200 or less, Wise is not for you.

The new Wise.com doesn’t charge a setup fee (TransferWise did), and costs are transparent. You can learn more on their pricing page.

RELATED LINKS

It’s the sales page where the magic happens. This is the page that gives you a return on your marketing investment. It is on this page where we convert visitors to paying customers. Do you know the valuable elements of a high-converting sales page? You will soon. Keep Learning >

Content marketing is the backbone of the biggest success stories over the last decade. I’m referring to companies like Zomato, Canva, ThinkGeek, HootSuite and even Blendtec. It’s not surprising that so many brands are focusing on content marketing, given the average ROI is twice any other type of digital marketing. Keep Learning >